Diji, Chuks. J.

CPEEL, University of Ibadan, Nigeria

Title: Comparative Analysis of Nigeria Petroleum Fiscal Systems Using Royalty and Tax Optimization Models to Drive Investments.

Biography

Biography: Diji, Chuks. J.

Abstract

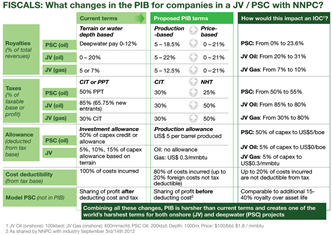

The adoption of any petroleum arrangement - concessionary or contractual - is a financial issue that is centered on how costs are recovered and profits divided, which is at the heart of taxation and economic rent theories. Hence countries are expected to make the tax system attractive for the IOCs in order to encourage inward investment. The effectiveness of any petroleum arrangement depends largely on the attractiveness of its underlying tax regime which, in turn, depends on the effectiveness of its design and implementation. The uncertainty created by the non-passage of the proposed Nigeria Petroleum Industry Bill (PIB) over the years has continued to impede investments in the oil and gas sector in Nigeria. Oil producers Trade Section (OPTS) and other stakeholders in the sector in Nigeria have expressed concerns over the federal government’s intention to change the laws governing the oil and gas industry including the fiscal terms. The aim of the study is to critically examine whether the Nigerian petroleum tax system is appropriately designed and effectively implemented to achieve the benefits the country desires from its petroleum taxation arrangements. The study reviews the current and post PIB upstream fiscal regimes and undertook a comparative examination of Nigeria’s fiscal regime against selected world fiscal arrangements. The study also determined how Nigeria’s fiscal regime holds up against key features of importance to government and prospective investors, which include degree of stability, flexibility, neutrality and how the regime distributes the burden of risk between the resource owner and the oil companies. The study concluded from preliminary studies that there is a correlation between fiscal terms (tax and royalty) and various profitability indexes (DCFR, PIR, AVP, PVP, MCI & payout). The global comparative analysis result also shows that Nigeria fiscal terms (pre & post PIB) are outside the competitive window and will invariably discourage foreign direct investments.